Mobile wallets aren’t just payment tools anymore, they’ve become one of the best ways to engage customers. By 2026, over 5.3 billion people will be using digital wallets. That’s half the planet with always-on access to your offers and rewards.

The big shift? Wallets aren’t static coupon holders anymore. They’re dynamic engagement hubs with push notifications, geo-triggers, and live loyalty benefits.

Let’s break down how brands can bring loyalty programs, incentives, and vouchers into Google Wallet and how Voucherify enables real-time updates that keep every pass instantly in sync.

A digital wallet is a secure app that stores payments and passes, loyalty cards, coupons, tickets, and gift cards, so customers can access them from their phone or smartwatch.

For loyalty and promotions, wallets matter because they combine ease of use with constant visibility. Passes appear on a customer’s lock screen, update in real time as balances or rewards change, and can trigger reminders when a customer is near a store or when a reward is about to expire.

Unlike email coupons that get buried or plastic cards that get forgotten, wallet passes live in a space customers check multiple times a day. This dramatically increases redemption rates, reduces friction, and strengthens long-term loyalty.

Think of wallets as a promotion container on your customer’s phone, one that doesn’t need an app download.

.webp)

While Apple Wallet provides powerful pass functionality, Google Wallet is taking a more event-driven, API-first approach that makes it particularly attractive for loyalty use cases. Several recent innovations highlight this:

Google Wallet currently supports four primary pass types relevant for brands: loyalty cards, gift cards, offers, and in-store payments. Each has specific advantages for engagement:

From an engineering perspective, Google Wallet loyalty is built on two objects:

To integrate, you start by enabling the Wallet API in your Google Cloud project and creating a LoyaltyClass for your program. Then you generate a LoyaltyObject for each customer. Distribution happens through “Save to Google Wallet” links, QR codes, SMS messages, or email buttons. When a customer taps the link, their Wallet instantly saves the pass with all the data you’ve defined.

The true value comes from updates. Using the API, you can PATCH LoyaltyObjects with new balances, tier progress, or reward eligibility. Google Wallet then surfaces these changes as push notifications, up to three times per day per pass, ensuring your program remains front of mind.

Go here for the full dev guide >

This is where Voucherify comes in. Voucherify acts as the source of truth for all loyalty data, gift cards, and promotions, while Google Wallet becomes the delivery and engagement layer. With Voucherify, you can connect loyalty and coupon workflows directly into Wallet without rebuilding your tech stack.

The integration works in two main ways:

In both cases, you can use third-party wallet pass providers (e.g., PassKit, Badge, WalletPasses) who abstract the heavy lifting.

Wallet passes stay up to date when your backend pushes new data triggered by Voucherify webhooks. Voucherify sends webhook events whenever points are earned, tiers change, or coupons are redeemed. Your backend listens for those events and PATCHes the Google LoyaltyObject with the updated balance or status.

For redemptions, the flow is reversed. When a customer presents a Wallet pass, the POS scans the barcode. That code is sent to Voucherify’s Redemptions API, which validates and processes the redemption. Voucherify then triggers another webhook so your backend can update Wallet again, reflecting the reduced balance or redeemed reward.

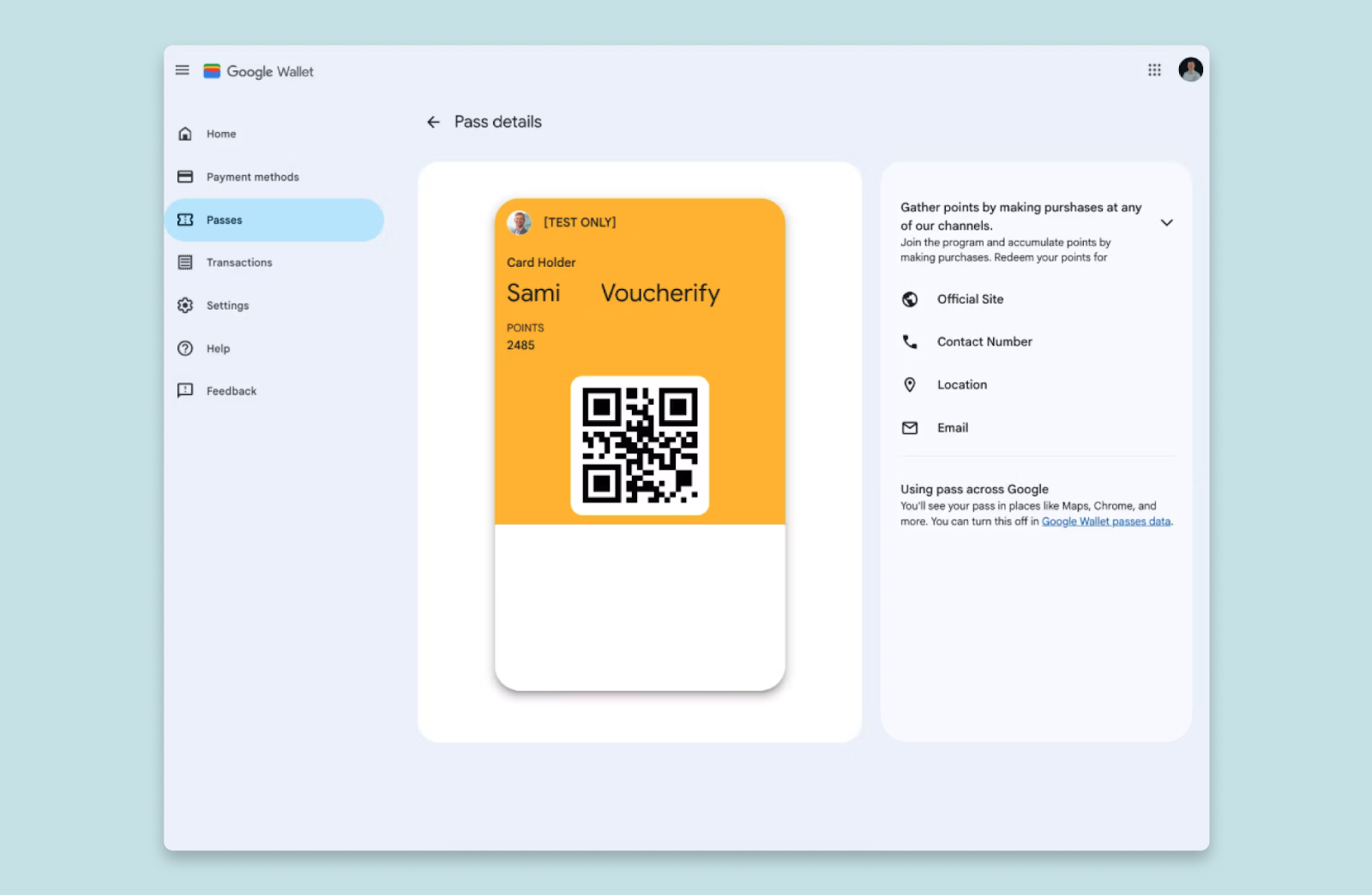

With Google Wallet handling the display and Voucherify powering the logic, loyalty becomes something customers simply have and not something they need to download. Our recent proof of concept shows how loyalty points can appear on a customer’s Wallet pass just seconds after a purchase, refreshing automatically once Google Wallet receives the update.

The PoC follows a simple flow:

In short: The customer places an order → Voucherify grants points → the Wallet pass updates in real time when the new data is pushed.

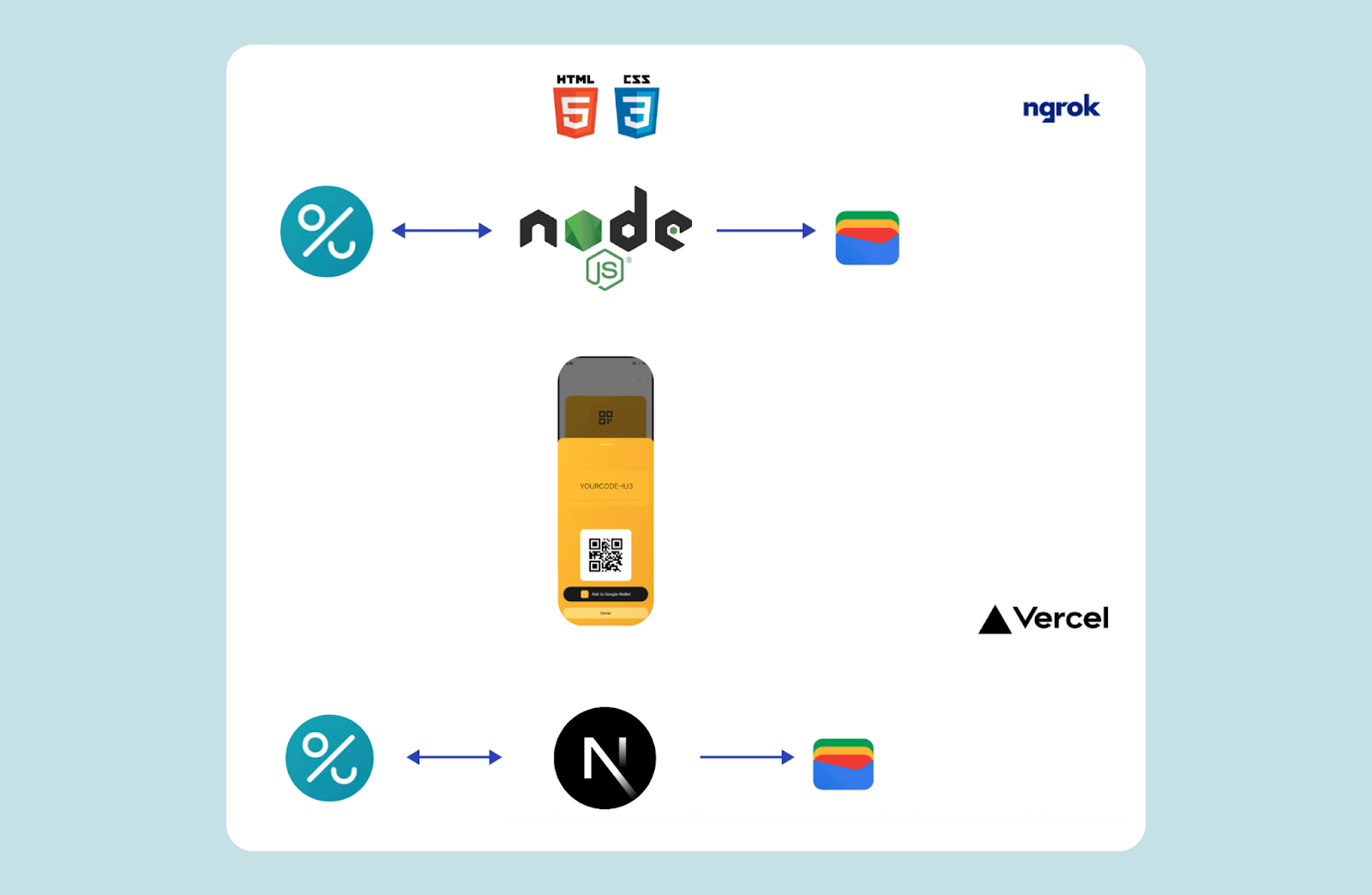

To prove how composable loyalty can be, we built a lightweight architecture that connected Google Wallet to Voucherify through a middleware service.

Stack components:

Each time Voucherify detects a loyalty event – whether it’s purchase, point earning, tier change – the middleware reconstructs the Wallet pass and sends the update via the Google Wallet API, so the customer sees up-to-date information as soon as Google Wallet receives the update.

The example shows that brands don’t need a heavy loyalty stack to support Wallet passes. With a fast incentive engine, the core pieces fall into place: issue, update, and stay in sync.

For QSRs and fast-moving retailers, speed and visibility matter. Wallet passes are built for environments where seconds count:

For brands who want higher loyalty engagement without asking more from their customers, Wallet passes offer a low-lift, high-impact alternative to traditional apps.

By combining Voucherify with Google Wallet’s engagement layer, brands unlock a set of powerful benefits:

We’re kicking off a limited beta for brands that want to experiment with Google Wallet loyalty cards, offers, and vouchers. If you're ready to test wallet-ready promotions, run A/B variants, and help us shape our templates, tracking, and controls, this is your chance.

.svg)