Throughout history, the banking industry has successfully weathered numerous challenges, including global financial crises. However, in an ever-evolving world where inflation rates fluctuate, a global pandemic reshapes our lives, and digitalization sweeps across industries, the banking landscape finds itself at a pivotal crossroads.

As financial institutions strive to adapt to these dynamic circumstances, the importance of a loyalty program cannot be overstated. Today, more than ever, customers seek meaningful connections with their banks.

In this blog post, I will explore how banks and other financial services can create a powerful and effective loyalty program in 2025.

The Covid-19 crisis was as a turning point for fintech adoption with an impressive 73% increase in interaction with fintech apps. New market challengers, such as Revolut successfully disrupted the way banking is done an captured the mind of digital-savvy customers.

Traditional banks are now under significant pressure to keep pace with the new market reality and minimize customer attrition.

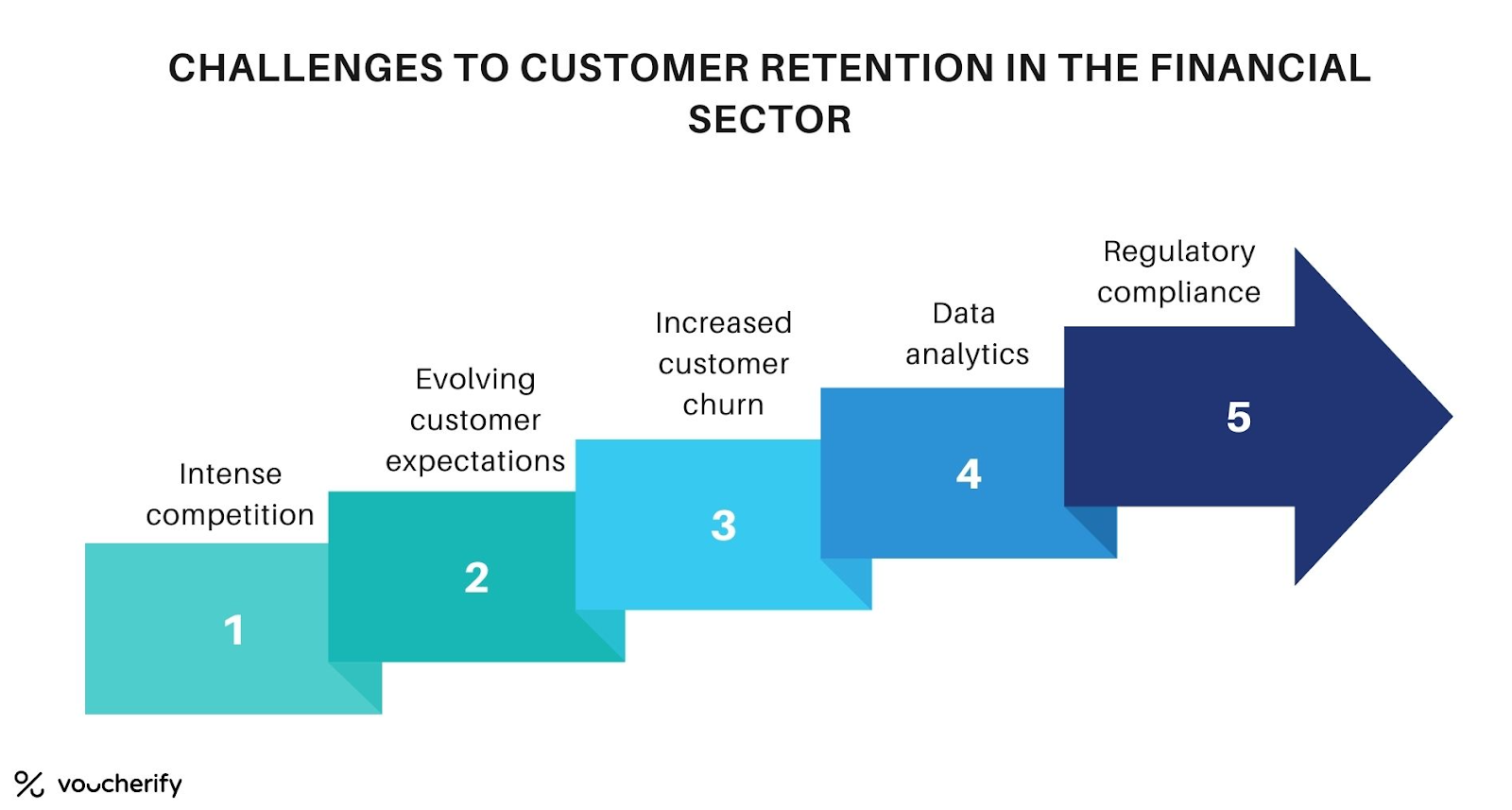

Plenty of customers view banking as a transactional relationship rather than an ongoing engagement. Consequently, banks face several challenges in terms of deepening loyalty and fostering customer retention:

Learn more: Must-Have Terms and Conditions for Loyalty Programs in 2023

Addressing these challenges requires banks to be proactive in understanding customer needs, leveraging data analytics, and embracing digital transformation. One way to start building long-term customer relationships is by establishing a bank loyalty program.

A bank loyalty program is a marketing strategy employed by the banking industry to incentivize customer loyalty and reward valued clients for their ongoing business and engagement with the bank. These programs are designed to encourage customers to continue using the bank's products and services and often offer various benefits and preferred rewards in return.

Implementing a loyalty banking program enhances customer engagement by creating a sense of exclusivity and rewarding customers for their loyalty. By offering incentives, rewards, and personalized experiences, banks can foster a stronger emotional connection with customers, increasing their likelihood of staying with them and engaging in additional banking activities. This, in turn, boosts customer retention rates and strengthens the overall relationship between the bank and its customers.

A well-designed loyalty banking program has the potential to significantly increase customer engagement. By offering tangible rewards, personalized offers, and exceptional customer experiences, banks can demonstrate their commitment to their customers' financial well-being.

According to Semrush Blog, as much as 89% of companies state that “exceptional customer service” is crucial in terms of customer retention. Consequently, satisfied customers are more likely to remain loyal to the bank, advocate for its services, and potentially consolidate more of their financial activities with the institution, leading to long-term profitability for the bank.

A compelling loyalty program can differentiate the bank from its competitors and, consequently, attract new customers and retain existing ones. By offering unique and valuable rewards, banks can stand out in the market and create a positive brand image. A well-executed loyalty program can position the bank as a preferred choice for customers seeking personalized and rewarding banking experiences.

According to a Mastercard study, when cardholders receive personalized promotional offers, the reward redemption rises by 18%, and customer churn is reduced by 75%.

Therefore, one of the key benefits of bank rewards programs is the ability to offer tailored offers to customers. By leveraging customer data and insights, banks can personalize their offers and rewards to match individual customer preferences, needs, and financial goals. This personalized approach enhances the customer experience, making customers feel valued and understood, which, in consequence, leads to higher consumer satisfaction and loyalty.

Point-based programs are a popular loyalty program format in banking. Customers collect loyalty points based on their banking activities, such as account balances, transactions, or credit card usage. These points can then be redeemed for various rewards, including merchandise, gift cards, travel, or even cashback.

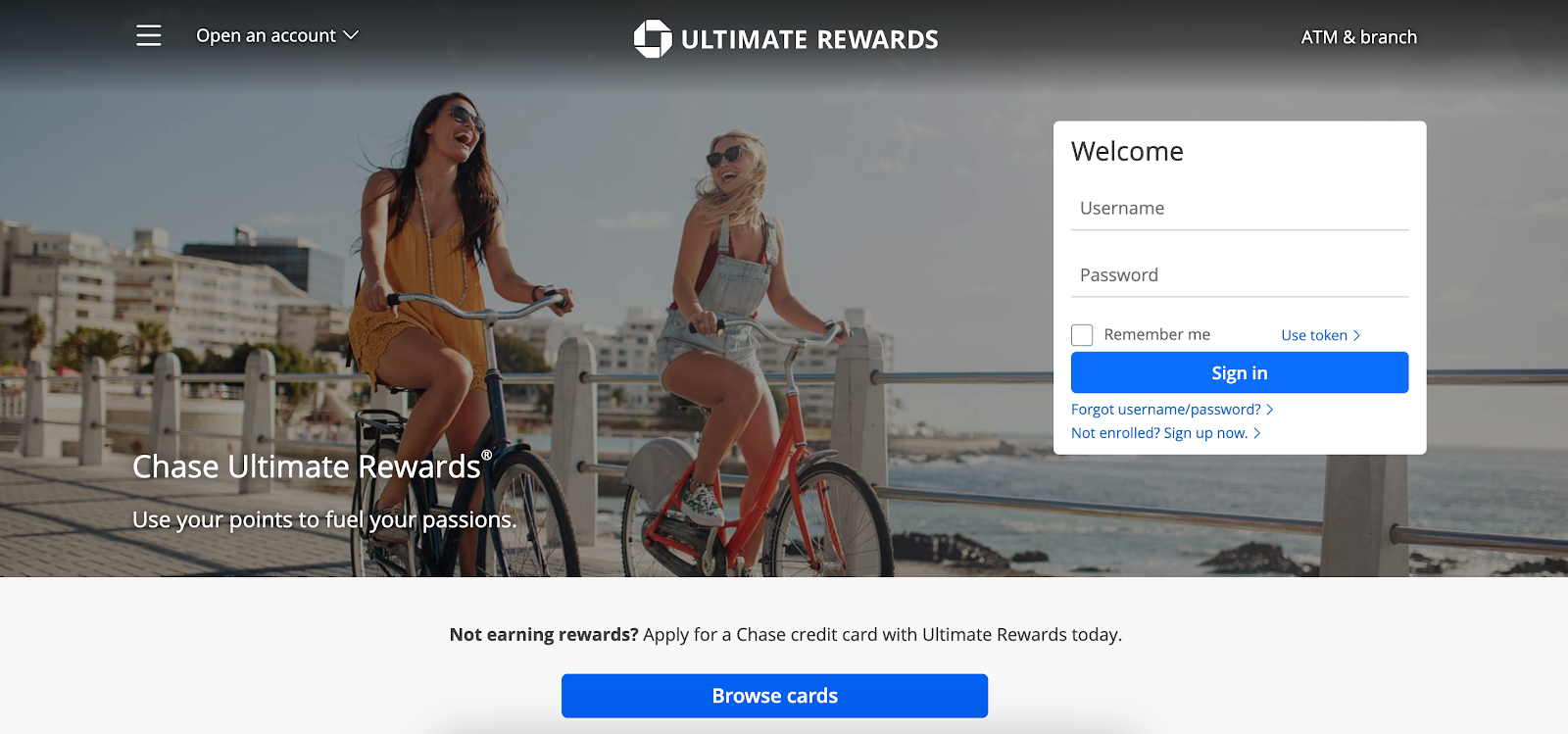

Chase Bank runs a point-based rewards program, Chase Ultimate Rewards, where customers can collect points on eligible purchases made with a Chase credit card.

The collected points, among other things, can then be used to:

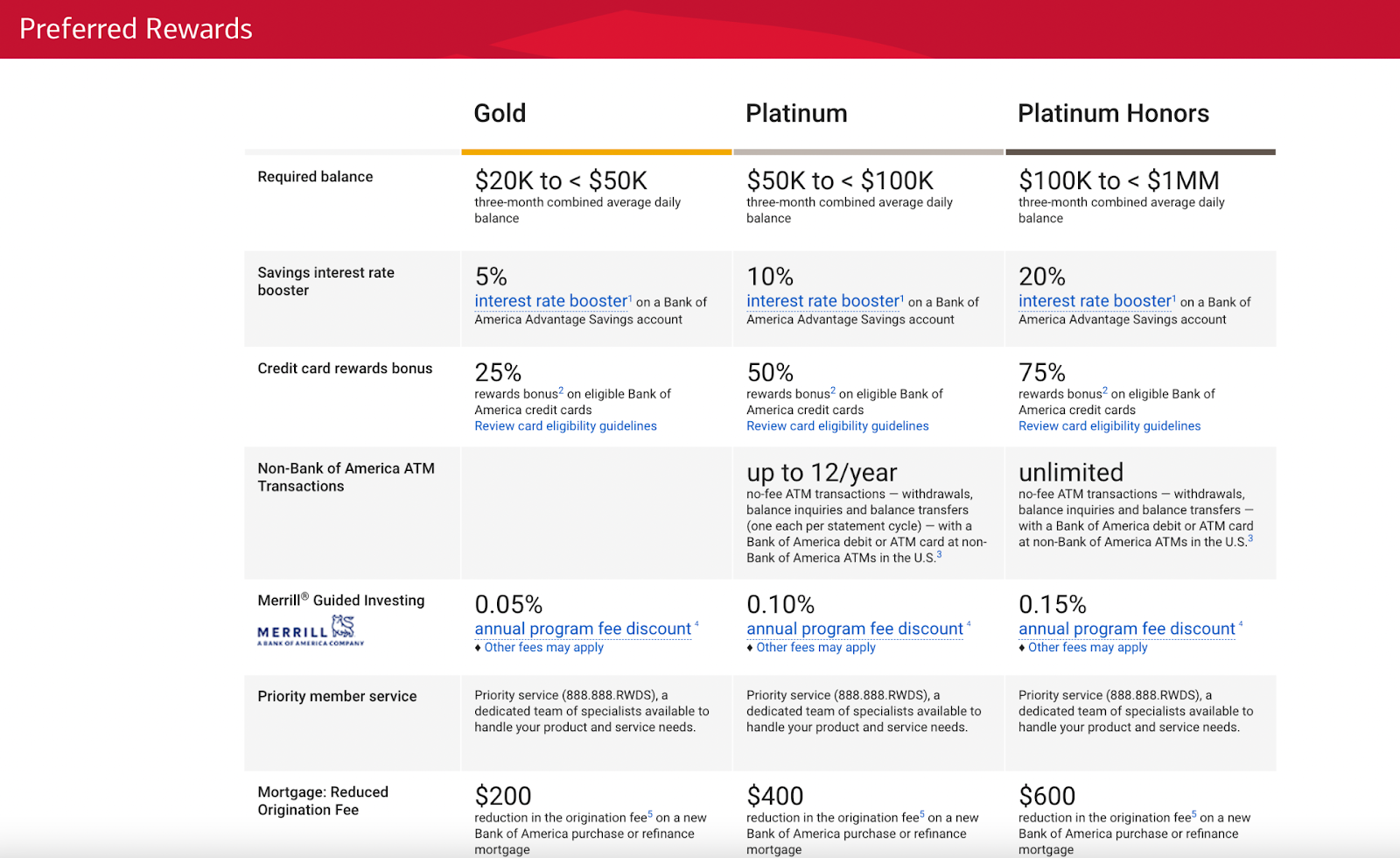

Tiered loyalty programs offer different levels or tiers of benefits based on customer loyalty or spending levels. As customers move up the tiers, they unlock additional privileges and rewards. Higher tiers often come with exclusive perks such as priority customer service, preferential interest rates, or access to exclusive events.

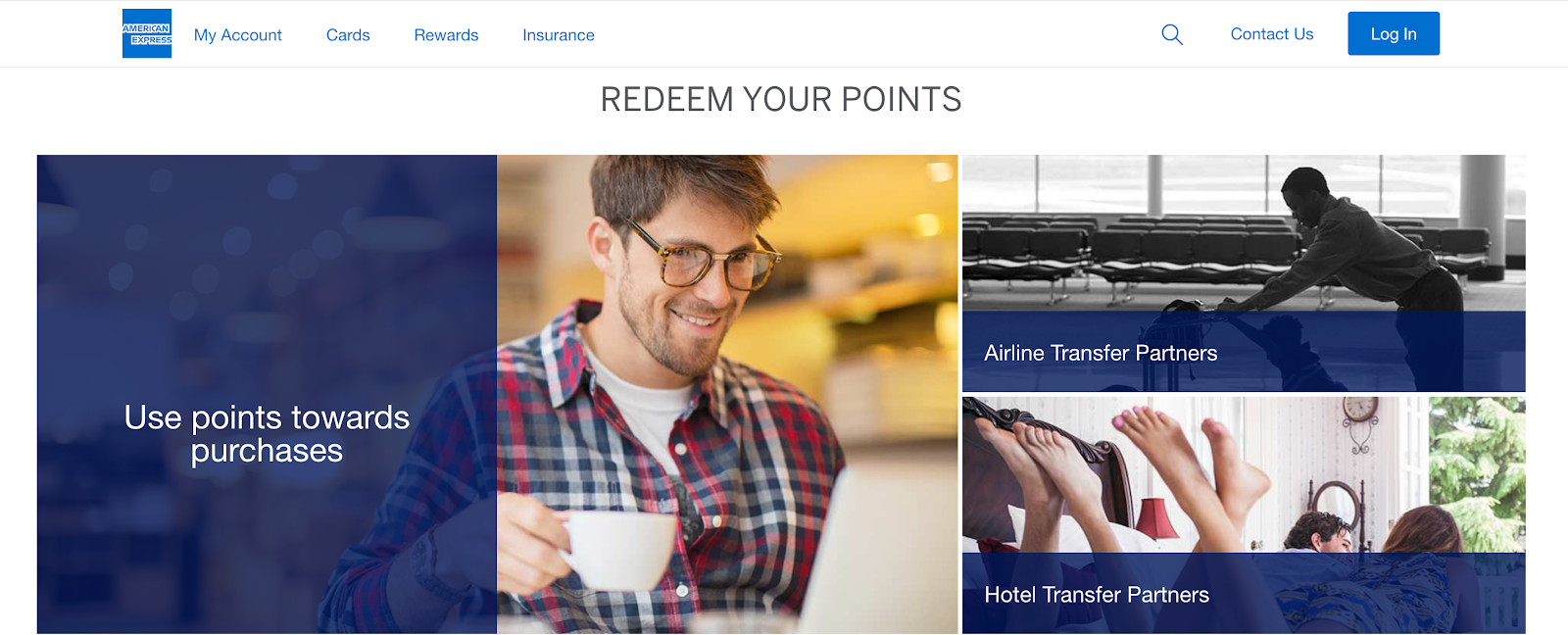

An American multinational financial services corporation, American Express, offers their customers the possibility to participate in Membership Rewards tiered loyalty program. The program is generally subscription-based: account holders pay a particular amount in order to find themselves in a given tier or can pay with points collected on their Corporate Card.

Each of the tiers has a separate membership fee (or Corporate Card number of points necessary to join) and, accordingly, offers different rewards for the customers. Among the rewards offered to American Express bank account holders are: point redemption for travel expenses, gift card purchases, credits at various stores, statement credits, and more.

Cashback loyalty programs provide customers with a percentage of their purchases as cash credit rewards. This encourages spending while providing customers with a tangible benefit. Additionally, with the rise of Buy Now Pay Later services, banks can incorporate cashback programs into these payment options, further enhancing customer loyalty.

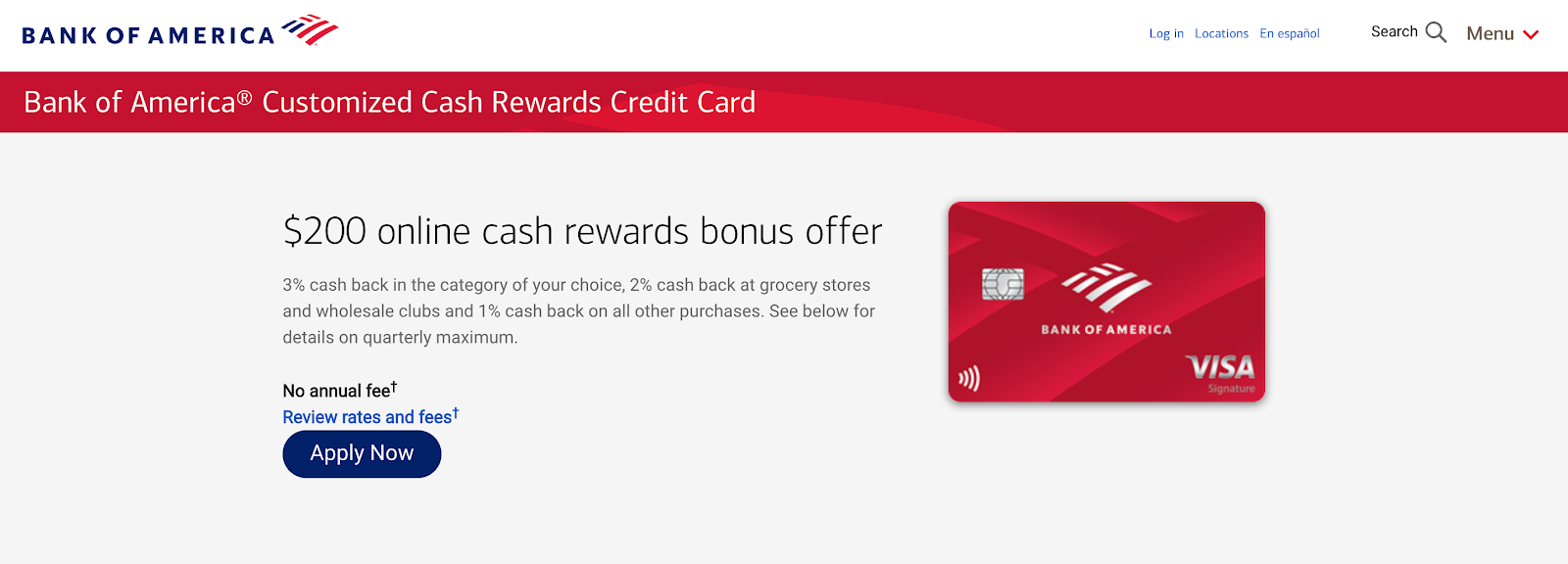

Bank of America offers the Cash Rewards program. Bank account holders can earn cashback on eligible purchases made with their Bank of America credit card. The cashback can then be redeemed as a statement credit or deposited directly into a Bank of America account.

The rules for earning cash back are as follows:

Credit card users will earn 3% and 2% cash back on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, then earn 1%.

Loyalty programs in banking can offer exclusive privileges and perks to their members. These may include access to airport lounges, concierge services, discounted or waived fees, preferential loan rates, or personalized financial advice. By providing these exclusive benefits, banks can create a sense of exclusivity and cater to their customers' unique needs.

UK's Barclays Bank offers a Premier Rewards loyalty program for its premier banking customers. This program provides benefits such as worldwide airport lounge access, travel insurance, lifestyle rewards, tech gadgets within the Tech Pack, and exclusive event invitations.

Coalition loyalty programs involve partnering with other businesses to offer a wider range of rewards and benefits. Customers can earn points and redeem rewards across multiple participating partners. This type of program increases the earning and redemption opportunities for customers and expands the reach and attractiveness of the loyalty program.

Nectar is a widely recognized coalition loyalty program in the United Kingdom. While it is not exclusively tied to banks, several banks participate in the program, allowing customers to earn Nectar points on their purchases. Some of the participating banks include Sainsbury's Bank, American Express, and Lloyds Bank. Nectar points can be redeemed for various rewards, including travel, shopping vouchers, and discounts at partner merchants.

Another example of a highly-regarded coalition loyalty program in fintech is Revolut Rewards. Revolut has consistently delivered on its promise of being the one app for all things money. With an impressive customer base of over 18 million personal users and 500,000 business users worldwide, Revolut has achieved "unicorn" status and undeniable success.

Their fintech customer loyalty program offers a vast range of partner discounts and instant cashbacks.

With the rise of digitalization, integrating loyalty programs into digital wallets has become increasingly popular. Customers can earn and redeem rewards seamlessly through their mobile banking apps or digital wallets, making the loyalty experience more convenient and accessible. This integration enhances the overall customer experience and encourages engagement with the loyalty program.

Learn more: What are digital coupon wallets?

Citi Bank's ThankYou Rewards program enables customers to earn points on their eligible Citi credit card transactions, including those made via digital wallets like Apple Pay, Google Pay, and Samsung Pay. These points can be redeemed for various rewards, including travel, merchandise, and statement credits.

Now that we are already familiar with the types of bank loyalty programs, let's see what sorts of rewards you can incentivize customers with.

Loyalty programs in the financial sector can offer a variety of incentives to encourage customer loyalty by providing offers that, for instance, help customers to pay off their mortgage or lower their interest rates.

Here are some common incentives that banks may offer within their loyalty programs:

As customer expectations evolve and competition intensifies, every financial institution needs to stay ahead by offering compelling rewards and incentives in order to increase customer lifetime value. Ultimately, financial loyalty programs are much about meeting the needs of those who buy bank products and services.

Here are a few things that may help you achieve success when creating your own banking loyalty strategy:

Successful bank rewards programs begin with a clear and attainable rewards structure. Bank customers should understand how to earn points or rewards and what to expect in return. Transparency and excitement around the program are key. Rewards should hold value and align with customer preferences. Regularly reviewing and updating the rewards structure ensures its relevance and competitiveness.

Here is an example of the Bank of America, go-to US bank, and their rewards landing page with program mechanics explainer.

Personalization is vital for a successful loyalty program. Tailoring rewards to individual preferences creates a more meaningful experience. Offering a range of reward options lets customers choose what resonates with them. Leveraging data analytics provides insights for targeted offers and recommendations, enhancing the customer experience.

For instance, Revolut offers location-specific perks to their UK customers with tasty 30% cashback on London pubs and restaurants.

Seamless integration across channels is crucial. Customers expect a consistent experience in branches, online banking, apps, and customer service – real-time data synchronization enables convenience and accessibility. Banks must invest in technology for a unified customer experience.

Communication is key for engagement. A given financial institution must clearly communicate the program's value and keep customers informed about points, rewards, and promotions through channels like email, SMS, or in-app notifications. Personalized offers and interactive campaigns enhance the program experience and gather insights for continuous improvement.

Gamification adds excitement to loyalty programs. Progress bars, badges, and challenges motivate customers to earn more points and reach higher tiers. Collaborations for exclusive experiences or promotions create a sense of fun and engagement. These elements enhance the overall customer experience and strengthen their connection with the bank.

Creating effective bank loyalty programs in 2025 holds immense significance for both banks and their customers. Loyalty programs offer a range of benefits, including enhanced customer engagement, increased customer satisfaction, a competitive advantage in the industry, and personalized offers. They allow banks to build lasting relationships, gather valuable customer insights, and tailor their offerings to meet individual needs.

In this ever-evolving digital era, the loyalty equation becomes a powerful tool for banks and customers alike, creating a win-win scenario that strengthens relationships, drives mutual growth, and fosters a rewarding banking experience.

.svg)